On the flip side, if the current ratio falls below 1, it could be a red flag. This indicates that the company might not have enough short-term assets to settle its debts as they come due. This could lead to liquidity problems, which might require the company to borrow more or sell assets at unfavorable terms just to keep the lights on. Generally, it is agreed that a current ratio of less than 1.0 may indicate insolvency. Sometimes, even though the current ratio is less than one, the company may still be able to meet its obligations.

Example 1: Company A

The Current Ratio is a measure of a company’s near-term liquidity position, or more specifically, the short-term obligations coming due within one year. The current assets are cash or assets that are expected to turn into cash within the current year. Apple technically did not have enough current assets on hand to pay all of its short-term bills. In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround. Changes in the current ratio over time can often offer a clearer picture of a company’s finances.

Ask a Financial Professional Any Question

This can be achieved through various strategies, such as expanding into new markets, enhancing marketing and sales efforts, or launching new products or services. These typically have a maturity period of one year or less, are bought and sold on a public stock exchange, and can usually be sold within three months on the market. Learn more about Bench, our mission, and the dedicated team behind your financial success. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Current liabilities are obligations that are to be settled within 1 year or the normal operating cycle.

- A quick ratio of 2.0 shows that your company has twice as many liquid assets as needed to cover its short-term liabilities.

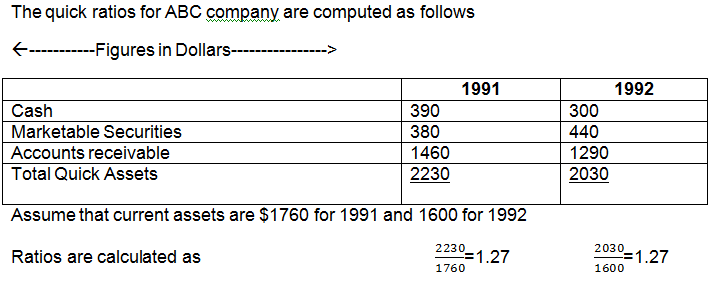

- The current ratio and quick ratios measure a company’s financial health by comparing liquid assets to current or pressing liabilities.

- If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default.

- This indicates that the company might not have enough short-term assets to settle its debts as they come due.

- This list includes many of the common accounts in a business’s balance sheet.

- Monitoring a company’s Current Ratio over time helps in assessing its financial trajectory.

Analysis

Business owners must focus on working capital, liquidity, and solvency so that their business can generate enough cash to operate. Managers should also monitor liquidity and solvency, and there are three additional ratios that can help you get the job done. Once you have determined your asset and liability totals, calculating the current ratio in Excel is very straightforward, even without a template. We have discussed a lot about the advantages and benefits of having an optimum current ratio. However, there are a few factors from the other end of the spectrum that prove to be a disadvantage. Standard costing has been a foundational tool in cost accounting for decades, helping businesses set predetermined costs for products and measure variances against actual costs.

Liquidity comparison of two or more companies with same current ratio

A well-managed business can increase credit sales and keep their accounts receivable balance at a reasonable level. If you can increase the turnover ratio, you’ll collect cash at a faster rate, and the company’s liquidity will improve. After consulting the income statement, Frank determines that his current assets for the year are $150,000, and his current liabilities clock in at $60,000. By dividing the assets of the business by its liabilities, a current ratio of 2.5 is calculated. Since the business has such an excellent ratio already, Frank can take on at least an additional $15,000 in loans to fund the expansion without sacrificing liquidity.

Nature of the Business – How Does the Industry in Which a Company Operates Affect Its Current Ratio?

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Over-trading companies are likely to face substantial difficulties in meeting their day-to-day obligations.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio. The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities. Traditionally, calculating the quick ratio was a manual process, where finance teams would pull data from various philip campbell author at financial rhythm page sources, including balance sheets and accounts, to gather current assets and liabilities. The current ratio describes the relationship between a company’s assets and liabilities. For example, a current ratio of 4 means the company could technically pay off its current liabilities four times over. Generally speaking, having a ratio between 1 and 3 is ideal, but certain industries or business models may operate perfectly fine with lower ratios.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The prevailing view of what constitutes a “good” ratio has been changing in recent years, as more companies have looked to the future rather than just the current moment. Some lenders and investors have been looking for a 2-3 ratio, while others have said 1 to 1 is good enough. It all depends on what you’re trying to achieve as a business owner or investor.

You have to know that acceptable current ratios vary from industry to industry. However, you have to know that a high value of the current ratio is not always good for investors. A disproportionately high current ratio may point out that the company uses its current assets inefficiently or doesn’t use the opportunities to gain capital from external short-term financing sources.

Therefore, the current ratio is like a financial health thermometer for businesses. It helps investors, creditors, and management assess whether a company can comfortably navigate its short-term financial waters or if it’s sailing into rough financial seas. It’s a key indicator in the world of finance that’s worth keeping an eye on to make informed decisions about a company’s financial stability. A company may have a good current ratio compared to other companies in its industry, even if it is below the general benchmark of 1. Ignoring industry benchmarks can lead to incorrect conclusions about a company’s financial health. Companies may need to maintain higher levels of current assets in industries more sensitive to economic conditions to ensure they can weather economic downturns.