The integration of the Internet of Things, facilitating real-time asset monitoring and improved security measures, has the potential to reinforce public belief in tokenized belongings. At Blockchain Technologies, we delight ourselves on our intensive experience in developing decentralized finance (DeFi) options. Our group is devoted to making sure that your RWA tokenization project is executed flawlessly, leveraging blockchain’s immutable ledger and sensible contract capabilities to safeguard your data https://www.xcritical.in/blog/real-world-assets-rwa-tokenization-in-crypto/ and transactions. By partnering with us, you’ll benefit from real-time monitoring and compliance with regulatory necessities, empowering you to optimize your capital allocation and threat management strategies.

Blackrock Is Betting Big On Real-world Assets: 4 Rwa Tokens That Might Turn You Into A Millionaire In One Yr

As the market evolves, figuring out the leading tasks which may be pioneering this space becomes important. This article will delve into the ten most promising RWA cash of August 2024, showcasing their unique options, benefits, and potential to reshape the future of finance. Choosing a real-world asset for tokenization is required while taking legal compliance, market price, and attainable liquidity into consideration. With choices for accredited traders to commerce tokens immediately, tokens are listed on security token exchanges for secondary buying and selling. Like any technology, tokenization of real-world property additionally has its share of limitations and challenges. One of the economic buzzwords is asset tokenization, which entails tokenizing real-world commodities.

Our Method To Rwa Tokenization Platform Improvement

With a robust give attention to regulatory compliance, Polymath streamlines the issuance process, making it easier than ever for firms to tokenize their belongings. Reserve Rights is a dual-token system designed to facilitate the tokenization of RWA and stabilize the worth of the Reserve stablecoin. By tokenizing RWA, Reserve Rights enables fractional ownership and makes high-value belongings extra accessible to a broader vary of buyers. For instance, in the traditional real property market, investing in massive business properties could be out of attain for a lot of people.

Elements Driving The Expansion Of Rwa Tokenization

Tokenized deposits allow quicker and safer transactions, enhancing the efficiency of asset management and investment processes. The Boston Consulting Group’s (BCG) report offers a complete outlook on the future of RWA tokenization, underscoring its potential to revolutionize asset management. The projection of $600 billion in belongings underneath administration by 2030 reflects the growing confidence in blockchain-based solutions and the increasing acceptance of tokenized assets among institutional and retail buyers alike. To summarise, the tokenization of real estate through blockchain know-how will make it accessible to small traders, leading to more affordable prices. As demand increases, precise adoption of the expertise might be beneficial, and cross-border commerce in actual estate will probably emerge as one other affect. One approach to categorize RWAs is by dividing tokenized assets into tangible and intangible classes.

Real World Asset Tokenization Growth Company

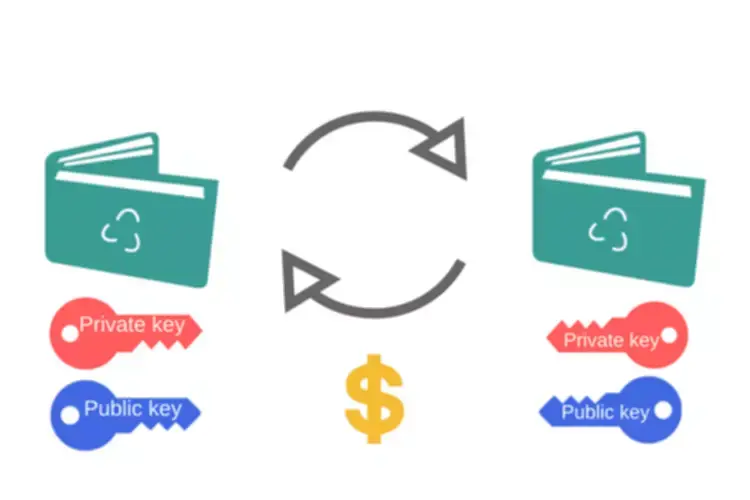

Lastly, merely issuing an asset isn’t enough; there should even be sturdy market liquidity and demand for it to succeed. The focus within the marketing and distribution of actual property property is on which cost methods are accepted and details about digital wallet use. To start, the tokens are allotted to buyers in the course of the initial distribution. Secondary trading closes this process wherein focus is shifted in the direction of buying and selling these tokens in trade platforms. Updating and bettering the actual world asset tokenization platform growth as needed, in addition to resolving any problems that will occur, represent maintenance and offer assistance to users.

We help companies realize the complete worth of their belongings within the digital age by offering services including token creation, sensible contract development, and platform integration. It provides liquidity for previously illiquid assets such as real estate, art, and commodities, enabling fractional possession and extra investment access. Blockchain know-how improves transparency and effectivity in asset trading by minimizing middlemen and associated bills. It provides programmable belongings, allowing for automatic compliance, dividend distribution, and smart contract performance. It also broadens the DeFi ecosystem by connecting conventional finance to decentralized protocols, hence growing yield-generating and risk-management potential.

Investing in real word assets corresponding to — company shares, work, actual property, and many extra are promising. Tokenization in real-world property guarantees many advantages and promotes the democratization of funding. Currently, the token financial system is flourishing, and plenty of industries benefit from it. One of the buzzwords related to the economy is asset tokenization which means tokenizing real-world commodities.

Understand the market needs in addition to the legislation governing tokenized belongings. In this article, we will understand tokenization of real-world assets and the method to tokenize a real-world asset. In phrases of real-world belongings, we will think about real-estate asset tokenization and can look over its benefits and challenges in tokenizing real-world property. Tokenized RWAs additionally current some dangers, mainly on the facet of the custody of physical belongings, which have to be reliably accomplished, and the connection to the outside world.

- Create the inspiration for RWA Tokenization platforms which may be found in the true world.

- Mutual Funds are some of the unbelievable funding methods that supply higher returns…

- RWA may be represented on the blockchain network using digital tokens, making it easier to purchase, sell, and trade them.

By lowering entrance obstacles and diversifying portfolios, it democratizes investing choices. RWA tokenization providers maintain nice potential for converting real-world belongings into blockchain-based tokens. This real world asset tokenization companies democratizes access to previously illiquid property by permitting fractional ownership and rising liquidity. RWA tokenization services additionally facilitate global investing by permitting for international transactions and decreasing entry obstacles for regular traders. RWA tokenization providers have the potential to change banking by unleashing billions of dollars in latent asset worth and enabling a more equitable monetary environment. Pendle Finance, a pioneering decentralized protocol, permits customers to tokenize future yield streams from DeFi platforms.

We make it potential for you to split useful belongings into manageable halves that permit you to create diversified portfolios and attract a larger pool of potential buyers. Bonds, loans, and different debt instruments can be tokenized, creating a extra liquid secondary market and enhancing access to capital. Shares in professional sports activities teams could be tokenized, permitting fans and traders to personal a bit of their favourite groups. Businesses can tokenize their accounts receivable, allowing them to be traded on secondary markets and improving cash flow.

Using real-world property as trade receivables and invoices as security, the platform lets corporations tokenize them and access liquidity by way of its Tinlake course of. The problem of getting loans for small to medium-sized companies (SMEs) causes a serious ache point in the banking sector that centrifuges help to solve. Centrifuge is producing contemporary liquidity possibilities by bridging the hole between DeFi and real-world assets, which could translate into more rewards for token holders. The initiative has additionally teamed with well-known DeFi sites like MakerDAO, due to this fact enhancing its reputation and growth prospects. BlackRock’s rising interest in RWAs makes Centrifuge a best choice for those trying to profit from this development since it interacts with standard finance.

The Real World Asset Ecosystem contains the entire precise objects we use and work together with daily. Real world asset tokenization platform helps every thing from bodily items like cars, homes, and property to infrastructure such as roads and bridges. In this article, we’ll explain what tokenized RWAs are, how they’re created, and the way Chainlink is the one platform that can provide a comprehensive answer for fulfilling the requirements of tokenized property.

As the crypto world continues to evolve, we can count on to see more RWA being tokenized and traded on the blockchain community. Ondo Finance is a decentralized platform that gives tokenization of real-world assets (RWA) on the blockchain, enhancing liquidity, transparency, and accessibility. By tokenizing RWA, Ondo Finance permits fractional possession and makes high-value belongings extra accessible to a broader vary of buyers. The Boston Consulting Group’s projection of $600 billion in assets under administration via RWA tokenization by 2030 underscores the immense potential of blockchain know-how to transform conventional finance. Driven by rising investor demand, regulated stablecoins, tokenized deposits, and CBDCs, RWA tokenization is set to revolutionize asset management by enhancing liquidity, accessibility, transparency, and safety. Tokenization is necessary for removing intermediaries, rising market liquidity, and facilitating speedier transactions.

The rise of real-world asset (RWA) tokenization marks a transformative period within the crypto panorama, providing unprecedented opportunities for traders and asset house owners alike. By converting bodily and digital assets into tradable digital tokens on a blockchain, tokenization enhances liquidity, transparency, and accessibility. Real World Asset (RWA) coins have gained significant traction within the cryptocurrency landscape, offering a bridge between traditional tangible assets and blockchain know-how. RWAs encompass physical belongings that maintain intrinsic worth, similar to real estate, commodities, and monetary devices, which can be digitized and traded on blockchain networks. This innovative method not solely enhances liquidity and permits for fractional ownership but also democratizes entry to funding opportunities. Leading the RWA tokenizing trend is Rexas Finance, whose platform seeks to transform asset ownership by increasing entry via blockchain expertise.

Tokenization allows businesses to maximize the utilization of their belongings by unlocking worth from underutilized or dormant property. By tokenizing these property, companies can generate revenue streams and optimize their asset portfolios. Utilizing dependable, high-quality off chain data from sources like Chain Link oracles to ensure the precision and dependability of knowledge pertaining to the tokenized asset.

Read more about https://www.xcritical.in/ here.