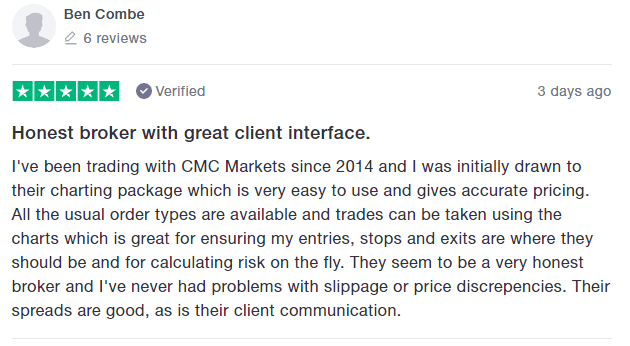

CMC Markets is well-trusted across the globe, and delivers a terrific trading experience thanks to its excellent pricing and selection of nearly 12,000 tradeable instruments. The mobile app is also good except it cannot be used in Malaysia. https://forexbroker-listing.com/ As I travel to Malaysia often, this has posed a problem for me and I need to look for another broker whose mobile app is accessible in Malaysia. Ease of navigation and the ability to customise my trading workspaceuser-friendly interface.

Great Broker

Regardless of the CMC Markets entity you choose — i.e., U.K., Singapore, Australia, Germany or Canada — the minimum deposit is zero. CMC Markets secured Best in Class honors for its research offering in our 2024 Annual Awards, thanks to its diverse lineup of high-quality in-house and third-party market research and analysis. We use dedicated people and clever technology to safeguard our platform. Labeled Verified, they’re about genuine experiences.Learn more about other kinds of reviews. Excellent program to test trading strategies including entry and exit points.

Non-Trading Fees

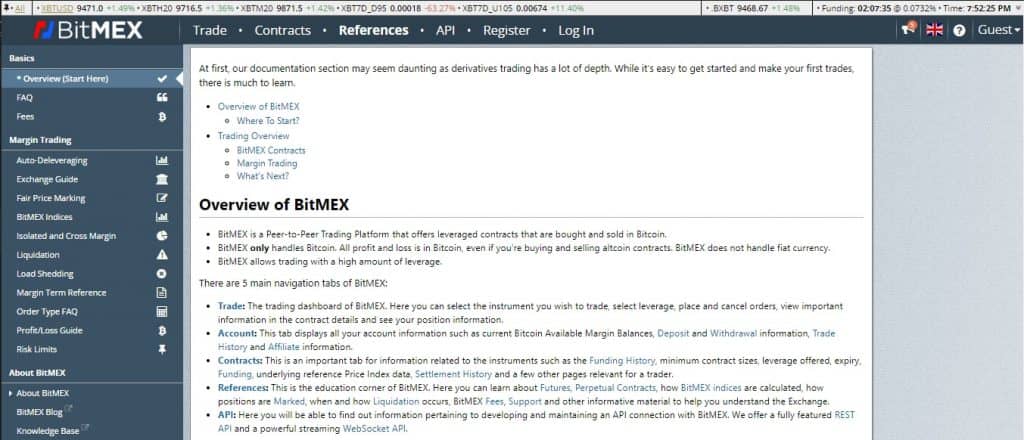

Educational articles on the website such as ‘How to Trade Bitcoin’ and ‘What is a trailing stop order? Webinars cater to both beginners and experienced traders and cover topics ranging from the outlook cmc markets review for the global markets to making the most of the Next Generation trading platform. The Artful Trader Podcast features interviews with industry experts and coverage of topics such as trading psychology.

CMC Markets Trading Instruments

Customer support can be extremely important if you have a problem with a trade, so the importance of being able to contact your broker during market hours to resolve an issue cannot be stressed enough. 74-89% of retail investor accounts lose money when trading CFDs. The broker offers a strong combination of low spreads, trusted regulation, and a vast degree of experience to add to the more than 10,000 available assets. Here, we will take a closer look at what makes CMC Markets one of the top choices for traders industry-wide.

Tradable Instruments

Investing and trading carry risks; it is important to use a broker that is well-capitalized to reduce your potential counterparty risk. With competitive pricing and almost 12,000 instruments spanning virtually every market and asset class, CMC Markets is a great choice for global forex and CFD traders. Furthermore, the CMC Markets Next Generation platform is powerful and versatile, with plenty of customization tools and configuration options. ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. However I do not now whether it is the same for comparatively larger positions.Over all, the best broker for me so far compared to all 5-6 brokers I have traded with.

An example of this is when you try to trade an instrument outside market hours. CMC Markets will generate the price manually so you can have access to liquidity. However, the broker tries to provide a fair price when this is done. You will find an impressive asset listing of over 10,000+ instruments. They can cater to individuals, corporate and international traders.

- Other fees that may apply to Retail CFD and Corporate account holders are additional market data fees.

- Also, the agent does not seem to be able to comprehend what I was referring to.

- This shows the dates and times scheduled for different global events as well as their predicted impact on the market.

When it comes to making deposits and withdrawals from the broker, several methods are accepted. These include wire transfers, credit cards, and certain eWallets such as PayPal. Whilst these services may have their own fees, the broker does not typically charge any fees from their side on these deposits.

Some of the features and services will vary depending on which jurisdiction you open an account in. Next Generation does not have back testing capabilities, forcing some account holders to use MetaTrader 4, which is inferior to the homegrown platform in other ways. The same holds true for an API interface that permits the use of more sophisticated trading platforms that support algorithmic and automatic trading routines. Client positioning data embedded within the proprietary software is an excellent feature that could have been enhanced if social or copy trading was also available. At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers.

Forex broker that has successfully adapted to the ever-changing online brokerage landscape. The company is listed on the London Stock Exchange (LSE) under the ticker symbol, CMCX. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

The product range is plentiful for new traders as well as professionals. Aside from the ambiguous free-floating fee structure, CMC Markets offers one of the most customizable trading dashboards on mobile and desktop today. Australian traders can also access the webIRESS platform from $126.50. There are fewer drawing tools and overlays available with the Pro platform than the Standard. This is likely because the Pro platform offers more complex tools and eliminated some of the ‘simpler’ ones. If you trade real shares as an Australian resident, these are the fees you need to bear in mind.

They respond quickly and are very helpful in setting things up. Mobile app and the web based market platforms are easy to use. As a regulated entity in Australia, CMC Markets is held to very high standards that ensure a high degree of security for client funds and interests. Furthermore, excellent customer service covering a wide range of languages only strengthens the overall value proposition. For users who wish to engage a guaranteed stop-loss on a trade, there is also a fee assessed by CMC.

The platform features advanced charting with 115 indicators/overlays, 12 chart types, and 35 drawing tools; highly customizable watchlists; client sentiment; and a streaming Reuters feed. Charts can be popped out to build and optimize complex desktop layouts. Clients who want to study long-term trends will find price histories going back 20 years on major instruments. The platform also provides price projection and pattern recognition tools as well as a built-in connection to the client-based trader’s forum.

It gave me access to trade all the 10,000+ trading instruments available. The CMC Markets website has a dedicated learning section where a selection of comprehensive trader education is provided. I would’ve preferred if they had a bigger selection of educational resources. I found the support page to have a glossary of approximately 220 financial markets terms along with detailed definitions. It also has top Frequently Asked Questions (FAQs) grouped accordingly.

Most of the trading costs at CMC Markets are charged through the spread which is competitive within the industry. The spread is also the way that CMC makes money, specifically through customer trades that “cross” the bid / ask spread. Guaranteed stop losses (GSLO) are available only on Next Generation at an added premium that is charged to your account.