Above is daily chart of Google and a 10-minute chart of Facebook showing the exact trigger for entering a position. One advantage of trading any breakout is that it should be clear when a potential move has been invalidated – and wedge trading falling broadening wedge is no different. I wish you to be healthy and reach all your goals in trading and not only! Never give up on this difficult way which we are going to overcome together! After the two trendlines have been formed the pattern can be identified.

When Are Traders Pessimistic During the Falling Wedge Pattern Formation?

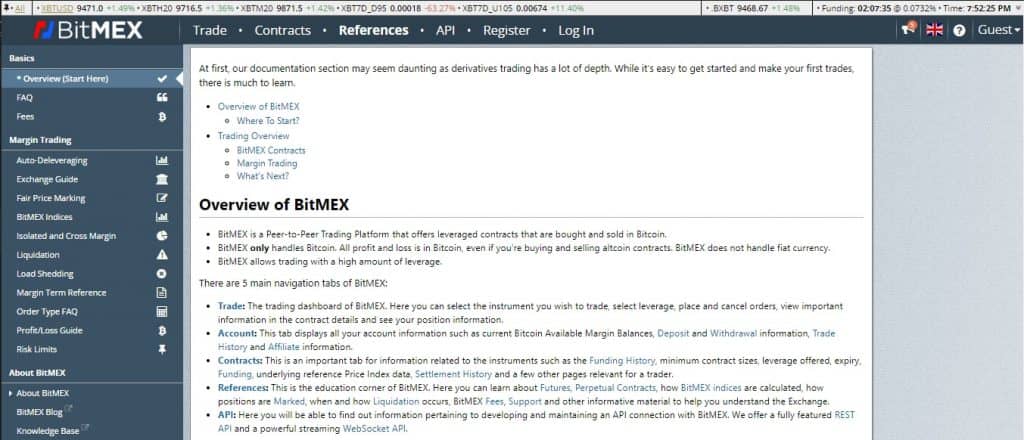

Because the falling wedge is a bullish chart pattern, aggressive traders will typically wait for price to break above the upper resistance line before they will execute a long position. Conservative traders, on the other hand, will generally wait for price to retest the upper resistance line from above before they will execute a long trade. Just keep in mind though, that a retest of the breakout level might not always happen and result in a trader missing an entry. In the Gold chart below, it is clear to see that price breaks out of the descending wedge to the upside only to return back down.

What Are The Risks Of Trading Falling Wedges?

All falling wedge pattern statistical data has been calculated by backtesting historical data of financial markets. Falling wedge patterns can be traded in trading strategies like day trading strategies, swing trading strategies, scalping strategies, and position trading strategies. Fifthly in the pattern formation process is the completion of the falling wedge when the price apporoaches the apex which is the point where the two trendline converge. At this stage, the pattern is considered formed, but it is not yet confirmed.

What is the falling wedge chart pattern?

To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. The Falling Wedge is a bullish pattern that suggests potential upward price movement. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Falling wedges can develop over several months, culminating in a bullish breakout when prices convincingly exceed the upper resistance line, ideally with a strong increase in trading volume. Performance of descending broadening wedges is near the bottom of the list.

Plan your trading

Although it is necessary for the price action to criss cross the pattern it is not required for there to be consecutive opposite trendline touches to be valid. With the Ascending Broadening Wedge formation we are looking for three peaks and three valleys with tops and bottoms forming the trendlines. The Ascending Broadening Wedge is one of six Broadening Wedge patterns to be found in price charts. Mean Reversion Definition Reversion to the mean, or “mean reversion,” is just another way of describing a move in stock prices back to an average.

In an ascending broadening wedge, the pattern is considered bearish, suggesting a possible reversal to come. The pattern is formed by two diverging bullish lines, with the upper line acting as resistance and the lower line as support. The pattern is considered valid if it shows good oscillation between the two upward lines.

The pattern typically involves diverging trend lines connected by a series of price peaks and troughs. When trading these patterns, it is crucial to follow specific entry and exit strategies to maximize profits and mitigate risks. On the other hand, a descending broadening wedge is often recognized as a bullish pattern, indicating a potential reversal to the upside. Similar to the ascending variation, this wedge displays price movements between two diverging lines.

Depending on the previous market direction, this “bearish wedge” could be either a trend continuation or a reversal. In other words, during an ascending wedge pattern, price is likely to break through the figure’s lower level. The falling wedge pattern psychology involves an initial bearish sentiment during the market price consolidation with a slow price decline lower phase.

New cheat sheet template on Reversal patterns and continuation patterns. Entry, SL, and PT have all been included.I have also included must follow rules and how to use the BT Dashboard. When price touches the bottom trendline for the third time and starts climbing then buy. Two touches to form the horizontal trendline and two touches to form the sloping trendline. For example, price makes the third valley and touches the provisional trendline (made by the first two valleys), confirming the pattern.

There are several major types of wedge chart patterns that technicians scan for. Very often these patterns have partial rises and partial declines that are followed by a breakout. When price rises from the lower trendline and fails to make the upper trendline it is likely to breakout lower.

Moreover, the use of divergence in conjunction with other technical analysis tools reinforces the significance of the identified patterns. To reiterate, broadening wedges can be a valuable tool for traders seeking to identify potential reversals or continuations in the market. Recognizing the context in which these patterns form is essential to interpreting their implications accurately.

Just like in the other forex trading chart patterns we discussed earlier, the price movement after the breakout is approximately the same magnitude as the height of the formation. Which in case of breaking the Resistance of the wedge it can bring in a good setup for a long on the asset.Price makes a low and rises. We are looking for lower highs and lower lows in a tight range.The lower highs make a falling trendline, this forms the… Usually, a rising wedge pattern is bearish, indicating that a stock that has been on the rise is on the verge of having a breakout reversal, and therefore likely to slide. The reversal is either bearish or bullish, depending on how the trend lines converge, what the trading volume is, and whether the wedge is falling or rising. Incorporate falling wedges into bullish stock scans but view rising wedges with skepticism without robust secondary indicator confirmation.

While these patterns can be extremely profitable, they are not always reliable. The failure rate can range between 10% to 20%, depending on the type of wedge pattern and current market conditions. Wedge patterns have converging trend lines that come to an apex with a distinguishable upside or downside slant. Analyze volume surges on breakouts and incorporate momentum oscillator signals. Combining wedge pattern trading with secondary indicators boosts the probability of capturing outsized gains. Master this structured approach to trading wedge patterns for the optimal balance of risk versus reward.

As security prices bounce off the declining support line, buyers start to show some optimism that a price bounce will occur. As price narrows further between a price pullback and price bounce, traders are confused and lack confidence on the correct price trend direction. After a price breakout occurs, traders become extremely optimistic and hopeful of further price increases.

Notice that the two falling wedge patterns on the image develop after a price increase and they play the role of trend correction. Trading broadening wedge patterns requires careful consideration of risk and reward potential. Traders must monitor price action within the pattern structure and use other technical indicators to assess the overall market conditions and trend strength. When trading these patterns, it’s essential to use stop-loss orders and have a predefined exit strategy. An ascending broadening wedge is a specific type of this pattern, where the widening channel leans upward and is considered a bearish signal.

Thus, a wedge on the chart could have continuation or reversal characteristics depending on the trend direction and wedge type. The broadening wedge pattern is a unique chart pattern that traders can use to identify potential breakouts and short-term trend reversals. It is considered a bilateral chart pattern, which means that it can signal both bullish and bearish market situations. The pattern is formed by two diverging trend lines that connect a series of price peaks and troughs. As with rising wedges, the falling wedge can be one of the most difficult chart patterns to accurately recognize and trade.

A megaphone pattern takes its name from the widening shape that resembles a megaphone. It consists of two diverging trendlines, with one being an ascending line connecting higher highs and the other being a descending line connecting lower lows. To summarize, the interaction between volume, price action, and security prices within broadening wedges offers crucial information for traders and investors. Broadening wedges are unique chart patterns that can signify either a reversal or a continuation in the direction of the trend.

- By comparing the price action with technical indicators, traders can identify potential market turning points or divergence signals, helping to develop well-informed trading strategies.

- Both lines have now been surpassed, meaning that the pattern has broken.

- The support line usually has to be a bit steeper than the resistance one.

- Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

Ascending Broadening Wedges tend to breakout in the direction of the previous price trend and so act as continuations of this move. The higher highs make a rising trend line, this forms the upper boundary to our pattern. The higher lows make a lower rising trend line, this forms the lower boundary to our pattern. The best way to think about this is by imagining effort versus result.

In other words, effort may be increasing, but the result is diminishing. In this post, we’ll uncover a few of the simplest ways to spot these patterns. Likewise, will give you the best way to predict the breakout and trade them. Falling wedge pattern books to learn from are “Technical Analysis of Financial Markets” by technical analyst John Murphy and “Getting Started In Chart Patterns” by Thomas Bulkowski.

The falling wedge pattern formation process begins with a price downtrend with market prices converging between lower swing high points and lower swing low points. These sloping lines are basically support and resistance levels that move in a converging pattern . The Descending Broadening Wedge is essentially the opposite of the Ascending Broadening Wedge. Wedges are a common continuation and reversal pattern that tend to occur in many financial markets such as stocks, forex, commodities, indices and treasuries. The price action within a broadening wedge can also be chaotic and unpredictable.

It’s usually prudent to wait for a break above the previous reaction high for further confirmation. Following a resistance break, a correction to test the newfound support level can sometimes occur. The Falling Wedge can signify both a reversal and a continuation pattern. In the context of a reversal pattern, it suggests an upcoming reversal of a preceding downtrend, marking the final low. As a continuation pattern, it slopes down against the prevailing uptrend, implying that the uptrend will continue after a brief period of consolidation or pullback.

In a broadening wedge pattern, the price exhibits increasing volatility as it makes higher highs and higher lows in a tight range. Volume is another factor that plays a key role in the formation and interpretation of broadening wedges. Together with the rising wedge formation, these two create a powerful pattern that signals a change in the trend direction.

The falling wedge is designed to spot a decrease in downside momentum and alert technicians to a potential trend reversal. As with most patterns, it is important to wait for a breakout and combine other aspects of technical analysis to confirm signals. The rising wedge can also occur within the context of a down trending market.

During a trend continuation, the wedge pattern plays the role of a correction on the chart. For example, imagine you have a bullish trend and suddenly a falling wedge pattern develops on the chart. A falling wedge continuation pattern example is illustrated on the daily stock chart of Wayfair (W) stock above. The stock price trends in a bullish direction before a price pullback and consolidation range causes the falling wedge formation. Wayfair price coils and breaks above the pattern resistance area and rises in a bull trend to reach the profit target area. The Ascending Broadening Wedge is a visually identifiable chart pattern in which the price range widens as it develops in an upward direction.

So it also often leads to breakouts – but while ascending wedges lead to bearish moves, downward ones lead to bullish moves. The falling wedge pattern opposite is the rising wedge pattern which is a bearish signal. Yes, a falling wedge pattern is reliable with a 48% average win rate making it one of the most reliable chart patterns. A falling wedge pattern most popular indicator used is the volume indicator as it helps traders understand the strength of a pattern price breakout. Falling wedge patterns form on all timeframes from short term 1-second timeframe charts to longer-term yearly timeframe price charts. Falling wedge pattern drawing involves identifying two lower swing high points and two lower swing low points and drawing the components on a price chart.

The support line of the pattern demonstrates a willingness amongst buyers to enter the market at lower price levels causing the market price to coil. The bearish to bullish turnaround in the pattern is caused by buyers aggressively buying which pushes prices higher in upward momentum. Being patient allows traders to thoroughly analyze the developing price action in the market and wait for the appropriate signals that confirm a trend reversal or a breakout. Patience helps traders avoid making impulsive decisions based on speculative movement and minimizes the risk of potential losses.